In this Issue:

51% Campaign

In recent weeks, the administration has taken issue with the 51% Campaign’s claim that only 43% of the budget is spent on academics and counters that UC has budgeted 68% on academics in FY 23. The AAUP would like to take this opportunity to clarify our argument in order clear up any misunderstanding and further the discussion on this matter. We applaud Faculty Senate Chair Dan Carl’s charge to the Faculty Senate Budget and Priorities committee to investigate this discrepancy and are willing to make ourselves and our data available to help with their work.

The 51% campaign was originally inspired by the Budget Solution white paper from the Dean’s Council created in February 2019.* (For the full Budget Solutions report, please see https://aaupuc.org/budget-solutions-from-the-council-of-deans-february-2019/). In this report, the Deans pointed to 2018 AAUP data analysis of the effect of PBB to illustrate how funding had been shifted away from the colleges. In FY 2010, the first year of PBB, colleges retained 50.69% of the revenue that they generated, but by FY 2017, the percentage of revenue retained by colleges dropped to 43%. The Budget Solution points out that had the colleges continued to keep 50.69% of their revenue the colleges would have had collectively an additional $52 million in their budgets. The AAUP has advocated that the budget model change to allow colleges to retain 51% of their revenue in order to ease the manufactured budget crises created by PBB and provostal taxes that have continuously syphoned money away from the colleges since the inception of PBB. The cumulative effect of this money drain has negatively impacted the colleges’ ability to serve students and pursue our academic mission – especially educating undergraduate students.

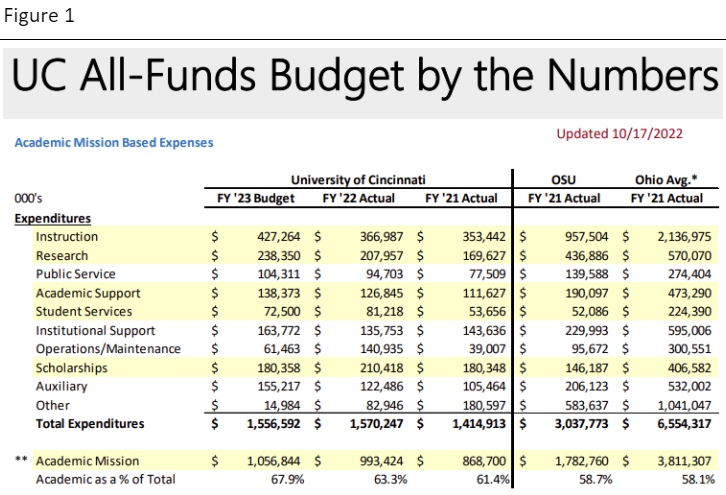

The administration claims that 68% of UC’s FY ‘23 budget will be spent on the academic mission and that UC spent 63.3% of the FY 22 budget and 61.4% FY 21 on the academic mission.** Moreover, the administration also claims that the percentage of the All-Funds budget spent on the academic mission in FY ‘21 exceeds that of both OSU and Ohio Average for FY ‘21 by nearly 10%. The administration includes instruction, research, academic support, student services and scholarships as academic mission expenses (See Figure 1). In FY ‘21, the difference in the percentage UC devoted to the academic mission differed from OSU by 2.7% and by the Ohio Average 3.3%. It is important to note that the FY ‘23 number is based on projected not actual expenses.

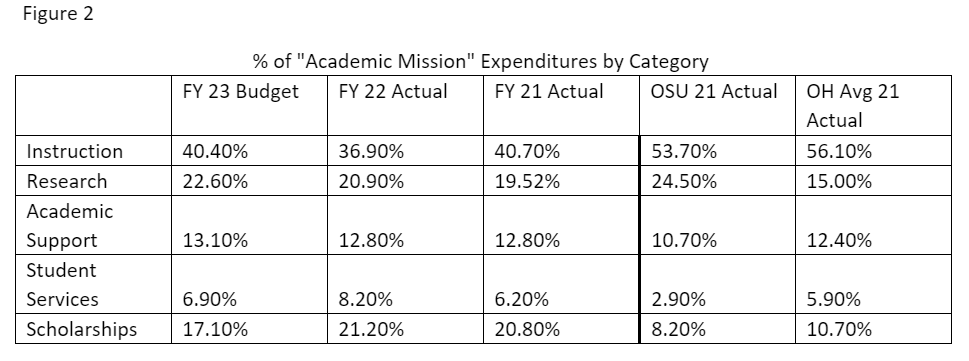

To identify the source driving UC’s expenses on the academic mission, the percentage of academic expenses that came from each of the categories mentioned above was identified (see Figure 2). This analysis helps illuminate the misleading nature of the administration’s claim. First, it illustrates that UC lags significantly in the percentage of academic expenditures devoted to instruction. UC’s expenditures on instruction lagged a staggering 13% behind the percentage OSU and 15.4% behind the Ohio Average in instructional spending. In FY ‘22, UC’s spending on instruction was a whopping 19.2% less compared to the Ohio average for FY ‘21. UC’s percentage of academic funds devoted to Academic Support, however, were higher than OSU and other Ohio universities by 2.4% or less. The percentage of academic funds devoted to student services was more than 2 times the percentage of academic funds at OSU devoted to student services, which is not insignificant.

Other than instruction, the largest variance in percent of expenditures is scholarships. UC’s percentage of scholarship expenses in FY ‘22 exceeded OSU’s FY ‘21 expenses by 13% and the Ohio Average’s in FY ‘21. Scholarship spending for other Ohio Institutions in FY 21 falls behind UC’s by 6.4% to 10.5% depending on the fiscal year. Including scholarships as part of the budget is problematic. With categories like instruction, it is a hard expense meaning the salaries of faculty providing the instruction must be paid by the university. Scholarships are different, though, because they aren’t an actual cash expense. A scholarship that offers reduced tuition does not require the outlay of additional funds by the administration. An analogy could be drawn to a restaurant patron using a coupon. The restaurant does not pay the customer to eat there, they simply make a smaller margin on the meal.

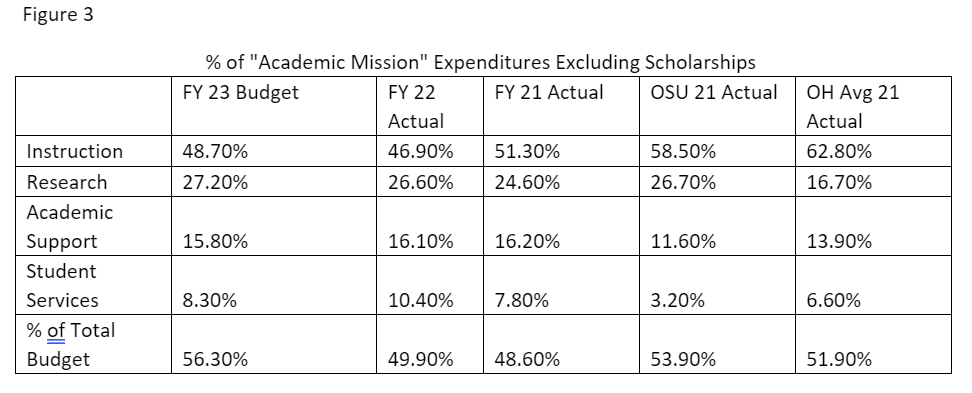

To help get a better idea of how UC’s actual expenses compare to those of other Ohio universities, the scholarships were removed from the academic expenses and the percentages devoted to the remaining categories were recalculated in Figure 3. With the scholarships removed, the percentage of the budget spent on academic expenses drops significantly. In fact, UC’s academic expenses were lower in FY 21 and FY 22 than OSU’s FY 21 and other Ohio universities FY 21 academic expenses. Only in FY 23 does UC’s percentage of funds devoted to the academic mission exceed OSU by 2.4 %, assuming that OSU has not changed the percentage devoted to academic expenses (FY 22 and FY 23 numbers for other universities is not available on IPEDS). The discrepancy in percentage of the budgeted funds devoted to student services and academic support is larger under this calculation ranging from 1.7%-7.2% and 1.9-%-4.6% respectively.***

We would appreciate a clear and detailed accounting of what types of expenses are included in academic support and student services, which often include highly paid administrators or other bureaucratic spending. Instruction is a fairly straightforward category, as the majority of the expenses are faculty salaries. The percentage spent on instruction compared to OSU and other Ohio universities is a real cause for concern, especially with years of record-setting increases in enrollment. Finally, we would like to see how these numbers break out in terms of unrestricted funds in addition to all funds. An All-Funds budget includes both restricted and unrestricted funds, but UC has very little choice in how restricted funds are spent. Looking at the unrestricted funds may further illuminate the administration’s spending priorities. Faculty must remain vigilant and continue to advocate for UC’s core academic mission.

* For the full Budget Solutions report, please see https://aaupuc.org/budget-solutions-from-the-council-of-deans-february-2019/.

** Please note that the AAUP prefers to use actual spending rather than projected spending.

*** Please note that the student services may be up in FY 22 due to federal funds due to the Covid Relief Act. Administration indicates that FY 22 may be an anomaly due to these funds. The other universities are likely to see increases in these funds as well.

Candidate Endorsement Update

Candidate Endorsement Update

Both candidates endorsed by the Chapter for the Ohio legislature won election in November. As expected, Catherine Ingram was elected to the Ohio Senate, replacing outgoing Senator Cecil Thomas. The Chapter also endorsed and contributed $5,000 towards Representative Jessica Miranda’s reelection effort. She was reelected by a small margin (2,000 total votes). This is an example of the Chapter’s financial support making a difference in a highly competitive race. Both Ingram and Miranda have a record of communicating with the Chapter and supporting higher education issues.

Overall, there was little positive election news statewide. Republicans increased their super-majorities in the House, Senate, and won every statewide race. The Chapter strives to be nonpartisan, but the Republican caucus has repeatedly introduced legislation that undermines the role of Faculty and has reduced public support for higher education. The Chapter will continue to work with both Republicans and Democrats whenever possible to advocate for higher education issues.

DID YOU KNOW…..what the best time of year is for you to retire?***

There is no simple answer to that question. There may be many factors that play into determining the best time of year to retire and individuals may have to consider circumstances very specific to them. However, there are some general facts that all of you should know and that should be helpful in determining what the best time of year is for you to retire:

- If you are 12-month faculty, you earn your base salary monthly as you work for it. You get paid at the end of each month for the work that you have provided during that month. Base payment for you is always up to date.

- If you are two-semester faculty, your annual base salary is paid out evenly over 12 months but you earn that salary by providing services during two semesters — usually, but not always Fall and Spring. Regardless of when you retire, the University must make you whole. You must be paid out for all salary that you have earned.

- If you retire under a traditional STRS (State Teachers Retirement System) or OPERS (Ohio Public Employees Retirement System) retirement plan, your first retirement benefit check is deposited around the 1st of the month immediately following your last day of work.

- If you retire under a traditional STRS or OPERS retirement plan, depending on number of years of service, you may have access to System provided/subsidized health insurance (STRS) or System subsidized health insurance (OPERS).

- If you retire under the ARP (Alternative Retirement Plan), there is no System provided and/or subsidized health insurance available to you. You will have to get health insurance on the private marketplace.

- If you retire under a Grandfathered Plan (for faculty hired prior to July 1977), there is a University health care plan available to you but it is costly. It may be more cost effective for you to get health insurance on the private marketplace.

Keeping those 6 points in mind, here are some generalizations about the best time of year to retire:

Faculty Members with 12-month appointments can retire anytime during the year — for considerations of pay and health insurance, it doesn’t matter when and it doesn’t matter what retirement plan you are under. When you retire, you will already be paid up to date and you will need to have health coverage ready immediately upon retirement.

The situation for Faculty Members with two-semester appointments is more complicated. Because they provide service on a semester basis, they typically retire at the end of the Fall Semester or at the end of the Spring Semester or anytime between the end of the Spring Semester and the end of the Academic Year in mid-August. Which is best may depend on the interactions among University pay, retirement system benefits, and health insurance.

All else being equal, two-semester faculty (with Fall and Spring assignments) who participate in the traditional STRS or OPERS retirement plans are generally better off retiring at the end of the Fall or Spring Semesters rather than at the end of the Academic Year in August. If you retire at the end of the Fall Semester in December, you will have earned ½ of your annual base salary. Since you will already have received University paychecks in September, October, and November, the University still owes you three more paychecks. You will be paid out for all three (December, January, and February) at the end of December. In addition, you will get your first retirement check at the beginning of January. Further, you can have STRS provided/subsidized or OPERS subsidized (however OPERS has recently and significantly reduced the size of its subsidy) health insurance in place for January 1st. If you retire at the end of the Spring Semester, at the end of April, you will have earned your entire annual base salary. Since you will have already received seven University paychecks (September – March), the University still owes you five more (April – August). You will be paid out for all five at the end of April. In addition, you will get your first retirement check at the beginning of May and you can have STRS provided/subsidized or OPERS (subsidized) health insurance in place for May 1st. If you wait until the end of the Academic Year in August to retire, you will not have received any more annual base salary than if you had retired at the end of April, but you will have lost out on retirement benefit checks for May, June, July, and August!

All else being equal, two-semester faculty who retire under the ARP or Grandfathered plans are generally better off retiring at the end of the Academic Year in August. Their retirement income is not coming from a state government related system but rather from whatever they decide to withdraw from their retirement accounts. They also are not eligible for System provided and/or subsidized health insurance. By waiting until August to retire, they can continue to be covered through the end of August by the health insurance provided as a benefit of the UC/AAUP Collective Bargaining Agreement, thus maximizing that benefit and putting off the need to be covered by private insurance until September 1st.

***Please keep in mind that we are not professional retirement advisors. You should discuss retirement options with UC Human Resources/Benefits and/or a representative of your retirement system and/or your personal financial advisor before deciding the best time to retire for you.